PM Modi Plays His Trump Card

I was asked by a business acquaintance two days before whether demonetization was on the cards? I asked him what makes him think so? To which I was told that was the bazaar buzz. My considered opinion to him was that it was very unlikely and he could go on his planned pilgrimage for I felt that the immediate costs would by far outweigh the long-term benefits.

When I heard the Prime Minister make the announcement last night I recalled an anecdote narrated by Dr.Paul Samuelson, the great economist and Nobel laureate. At the end of a talk on economic forecasting when he was asked if he had forecasted the Great Depression he said: “not a single economist in the star-studded Harvard economics faculty predicted it. Only the janitor of the building did!” Samuelson elaborated that the janitor used to perform a small service to the faculty by collecting salary cheques from them on Fridays for encashment for weekend spending, asked them to withdraw more or all as he felt that the banks will not open on the following Monday.” His advice went unheeded and the following week the faculty had to borrow money from the janitor!

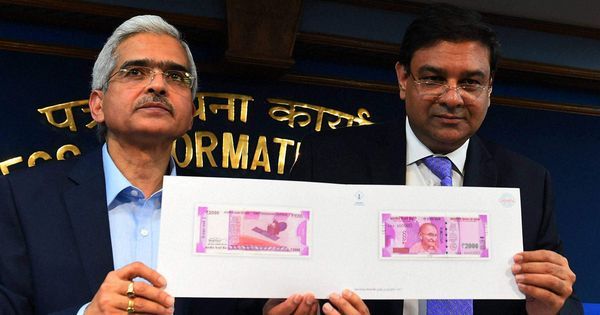

The moral here is that street buzz is often closer to the truth. For several days now I have been hearing on new Rs.2000 notes and an incipient demonetization. But I take pride in being rational and hence have to wonder on why the event overtook us? For a start as much as 86.4% of the value of notes in circulation is in Rs.1000 and Rs.500 denominations. The Rs.1000 and Rs.500 notes account for 7% and 17.4% respectively of the currency in circulation. These are significant numbers and a sudden withdrawal will obviously make an economy offering little cheer even more anemic.

Most middle and upper income households are a little strung out due to this. My wife and I too stock this morning and together we have Rs.600 in usable money. But we are mostly out of the cash economy managing our economy on credit and debit cards. But the vast majority of common folk still function with cash. My driver just told me that he has a few thousand rupees in 500’s and wanted some smaller notes.

It is true the PM has assured us that the old notes can now be exchanged for brand new notes by presenting them in the banks where the Aadhar and PAN numbers will noted to give the authorities a fix on the admitted owners of the cash. This is fair enough and most of us have little to get bothered about, though the queues at the banks will be a bit tedious.

The most competent extra-governmental authorities on these matters such as Baba Ramdev and Amit Shah have with predictable hyperbole compared this to the “surgical strikes” last month. The comparison might even be apt. For like the “surgical strikes” which were in reality a series of cross border raids to depths of 0.5 and 1.5 kms into Pakistan territory, this too is not without much depth. Like the LeT leadership, the black money enemy lies deeper inland and making a thrust here and there does not amount to a surgical strike. The leaders of our nation and the ruling elites understand the gravity and depth of the problem, but the baying hounds of public opinions too have to be addressed. We are being fobbed off with a few bones.

The term black money is all encompassing for income on which no taxes have been paid to the state. This income may be from legitimate sources or patently illegal activities such as smuggling, counterfeiting, corruption and narcotics. The estimates of how much black money is generated each year vary widely. But a widely cited, but still supposedly confidential study by the National Institute for Public Finance and Policy (NIPFP), commissioned by the government estimates the black economy in 2013 to be equal to about 75% of the GDP.

The previous NIPFP official study commissioned by the government in 1985 estimated it be equal to about 21% of the GDP in 1984 or Rs. 36418 crores out of a then GDP of Rs. 173,420 crores. In 2014 India’s GDP is estimated to be over $ 2.047 trillion corresponding to $7.277 trillion PPP ($1=INR60). In 2014 the Government of India was expecting to collect taxes and duties amounting to Rs. 13.64 lakh crores. This only means it is not collecting additional taxes and duties amounting to about 75% of this, other words about Rs. 10.4 lakh crores. This is huge sum and any government will drown in salivation thinking about all the good it can do with that money.

We can then contemplate investment to GDP ratios higher than China’s. What this will do for GDP growth and the expansion of prosperity can well be imagined.

India has only 35 million taxpayers of which 89% declare incomes in the 0-5 lakh slab. That means only 11% declare incomes above Rs.5 lakhs a year, an absurd figure considering Indians now purchased over 2.2 million new passenger vehicles and SUV’s last year, by all accounts a slow year.

Clearly most people who should be paying taxes are not. Because the UPA government failed to address this, the people booted them out, with the expectation that a Modi government will restore what rightfully belongs to the public. The NDA has used up almost thirty months frittering away good time. The public restiveness now evident and the protracted sluggishness of the economy have apparently persuaded them that a “surgical strike” was needed. So we are being thrown a few bones.

Last year Indians living in India illicitly exported $83 billion making us the second largest stashers of money abroad after the Chinese. This money is out of the purview of this demonetization. The government has so far demonstrated its inability to coerce or cajole the return of the estimated $500 billion stashed away in the last decade, as the economy expanded exponentially. Most of the other tax-evaded incomes are locked in property, jewellery and other fungible assets. The value of money stashed away as cash is trivial by comparison. Its mostly the likes of small businessmen, traders, artisans and peasant proprietors who keep stashes of hard earned cash at home or buried under. These will be the people you will meet tomorrow morning when you and I queue up at the banks to get our money back.

The rooting out of black money cannot be done by such pinpricks. That calls for the revamp of our system and undertake real and deep reforms. Look at what Arun Jaitely and company did to the GST law. We now have seven slabs and plenty of exemptions for the merry making band to sell discretion. We need a new start and for a good beginning we must make tax evasion a criminal offence attracting a mandatory jail sentence. We need a layer of courts trying and expeditiously disposing off economic offences. The government needs to put its money where its mouth is. Not the other way around, as is increasingly the case.