United States President Donald Trump’s 'Liberation Day' tariffs, unveiled on April 2, threaten South Asia’s economies with steep new costs—but could they also spark a long-overdue transformation?

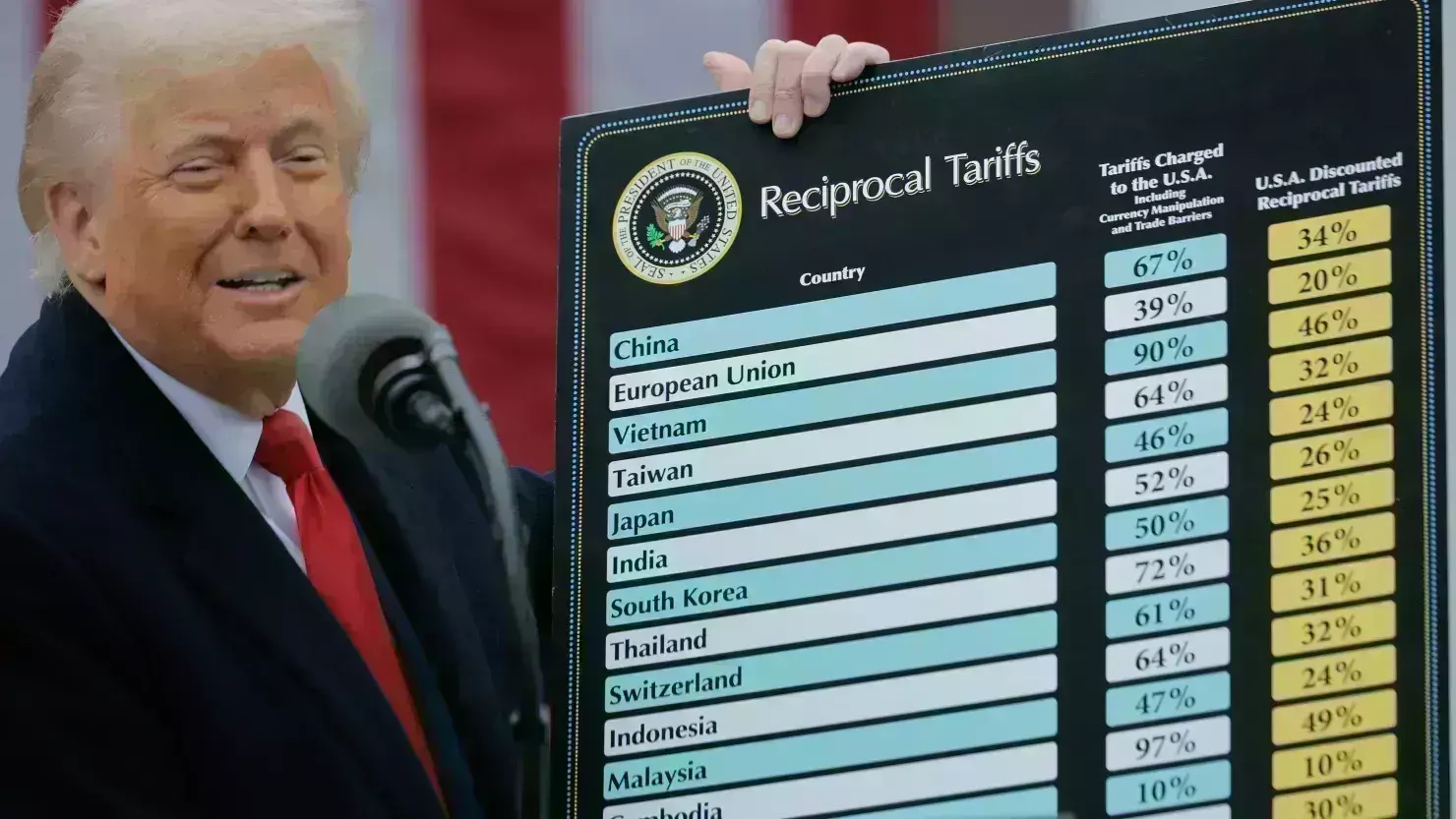

India had been charging 52% tariff on imports from the US; Pakistan 58%; Sri Lanka 88% and Bangladesh 74%. The high rates had prompted Trump to charge a Reciprocal Tariff (RT) as well as a Baseline Tariff (BT) on these countries.

Under Trump’s new regime, India will have to pay 26% as RT in addition to the BT of 10%. The RT applicable to Pakistan is 29% and with a BT of 10%, Pakistan will have to pay a total of 39%. In this way, it will be 44% plus 10% in the case of Sri Lanka (that is 54%). And 27% plus 10% in the case of Bangladesh taking the total to 37%.

However, in the case of Afghanistan, Nepal, and Maldives, the total tariff will be 10% only.

India

Donald Trump didn’t mince words - India’s 52% tariff on US goods, paired with what he called a “maze of burdensome testing rules,” had to go. For years, Washington charged India almost nothing in return, a lopsided deal now flipped with a 26% Reciprocal Tariff (RT) plus a 10% Baseline Tariff (BT)—36% total.

The US says India’s red tape, like the Bureau of Indian Standards’ quirky requirements, chokes trade. Lift those barriers, they argue, and American exports could surge by US$ 5.3 billion, cutting into India’s US$ 37 billion trade surplus from 2024’s US$ 129.2 billion bilateral haul.

Indian businesses aren’t thrilled. Manufacturers warn of pricier inputs, tangled supply chains, and jittery investors. Exporters, meanwhile, face US FDA approvals that can cost anywhere from US$ 9,280 to over US$ 540,000—a stark contrast to the minimal hurdles US goods face entering India.

Textile workers in Tamil Nadu or Gujarat might feel the pinch if costs climb too high. Yet there’s an upside - India’s 26% RT is lighter than Bangladesh’s 37%, Vietnam’s 46%, or Sri Lanka’s 44%. That edge could steer textile orders India’s way, especially as rivals falter.

New Delhi stayed cool-headed, eyeing it's bigger game against China. A quick concession—slashing motorcycle import duties—nodded to Harley-Davidson and US goodwill. Machinery, toys, and auto parts, now dominated by China and Thailand, might shift to India too, thanks to their higher RTs.

Pharma, a lifeline supplying nearly half of America’s generic drugs, dodges the RT bullet entirely.

With global exports at just 1.5% of the world’s share, India’s got room to grow—if it can tame corruption, boost infrastructure, and climb off the intellectual property 'Priority Watch List.'

Trump argued that India subjected US goods to a 52% tariff in contrast to Washington’s charging “almost nothing for years and years and decades”. The US government accused India of having “uniquely burdensome and/or duplicative testing and certification requirements”. The Bureau of Indian Standards (BIS) also did not fully align with international standards, the US complained.

However, the Indian textile sector might gain. Other countries in the textile sector such as Bangladesh , Vietnam, Cambodia, Pakistan, China and Sri Lanka are facing a higher RT than India.

Sri Lanka

Sri Lanka’s apparel industry is likely to suffer the greatest impact. The US is Sri Lanka’s largest export destination. It accounts for 23% of Sri Lanka’s total merchandise exports. As a result of the new tariff, Sri Lankan apparels might face loss of competitiveness, as the 44% RT on it is markedly higher than those imposed on key competitors like Bangladesh (with 37%) and India (26%).

It is suggested that Sri Lanka should cite its indebtedness and its need to follow IMF’s prescriptions and seek concessions from the US.

The Sri Lankan Government has already appointed a high-level committee to assess and respond to the challenge. Experts have recommended a sector-wise impact assessment for the apparel, rubber, agricultural exports, and logistics sectors.

Sri Lanka also needs to build multilateral coalitions with similarly affected countries like Vietnam, Cambodia, and Pakistan to jointly raise concerns at the WTO or regional trade forums.

Sri Lanka has been too dependent on the US market. It has to explore other markets and go for trade agreements. Sri Lanka has to do improve its position in the Ease of Doing Business ranking. The accent should also be on value addition, Research and Development and on welcoming FDI.

Bangladesh

Tariffs have been an important source of revenue in Bangladesh. Bangladesh will suffer it has to reduce its tariffs. In 2023, imports from the US were subjected to an average tariff of 15.7%, generating US$ 1.02 billion in customs duties on US$ 8.28 billion worth of goods. Agricultural products faced higher protection at 18.1%, compared to 14.1% for non-agricultural goods.

Bangladesh now faces a 37% US RT.Textiles and apparel, already burdened by some of the highest US tariffs, continue to face challenges. Pew Research highlights the disproportionately high taxes on clothing and footwear imports from Bangladesh.

But there is a silver lining. Bangladesh’s competitors face similar or even higher RTs. For example, Vietnam is subject to 46%, India 26%, Cambodia 49%, Sri Lanka 44% and Thailand 36%.

Corruption and other governance issues thwart the development of a competitive economy in Bangladesh. These issues will have to be addressed.

Pakistan

America is one of Pakistan’s most important trade partners. Nearly a fifth of the country’s exports go to the US.

In January 2025, the US exported US$ 310 million worth of goods to Pakistan and imported US$ 422 million from Pakistan, resulting in a negative trade balance of US$ 112 million for the US.

Analysts saw immediate hurdles created by the new tariff rate. But long term opportunities for Pakistan do exist. Experts say that Pakistan will have to seek diverse markets for its products and work with other countries in efforts to dissuade the US from staying on the present controversial course.

Nepal

In 2024, total trade between the US and Nepal reached an estimated US$ 241.4 million, with US exports to Nepal at US$ 120.9 million and imports at US$ 120.5 million, resulting in a goods trade surplus of US$ 0.4 million for the US. Trump has continued the 10% tariff on Nepalese goods. So, Nepal is off the hook for now.

But Nepal cannot be complacent. It has to fully exploit opportunities. The US-Nepal Trade Facilitation and Trade Enforcement Act of 2015 provides duty and quota free access to 77 Nepali products. Over the past five years the exports of Nepal to the US have increased at an annualized rate of 4.98% from US$ 110 million in 2018 to US$ 140 million in 2023. But Nepal will have to make full use of the opportunities already given by the US. Nepal has been recognized for its cheap labour. Therefore, even with the 10% BT, products made in Nepal could still be cheaper than those made in countries with higher tariff.

Maldives

The Maldives exports fish, including chilled and live fish, to the US. Over the past five years, fish exports to the US have totalled US$ 7.5 million. Hussain Afeef, Commercial Director of Ensis Fisheries, told the media that the US already imposes a 10% duty on Maldivian fish, and that the new policy has kept the rate unchanged.

But some competing countries face increased rates. That might help the Maldives expand the market. For instance, Sri Lanka's export tariff to the US has risen from 12% to 54%. Afeef noted that this could lead to higher prices for fish from competing countries, creating an opportunity for Maldivian fish to sell more.

South Asia faces a tariff storm, but those who adapt—streamlining trade, diversifying markets, or leveraging competitive edges—might emerge stronger.