Who Will Get the Nobel Prize in Economics Tomorrow?

Most awaited of all Nobels;

The truth is that there is no Nobel Prize in Economics, yet it is the most prized of the Nobels. Winners of these prizes often acquire the voice of god in the intellectual discourse of nations. What is thought of as the Nobel Memorial Prize in Economic Sciences, is officially the Sveriges Riksbank Prize in Economic Sciences in memory of Alfred Nobel.

It is administered by the Nobel Foundation established by the Swedish inventor of dynamite. The prize was established in 1968 by a donation from Sweden's central bank to commemorate the bank's 300th anniversary. It is now easily the most awaited of the Nobels. To know who will get in in 2021, we will have to wait till tomorrow.

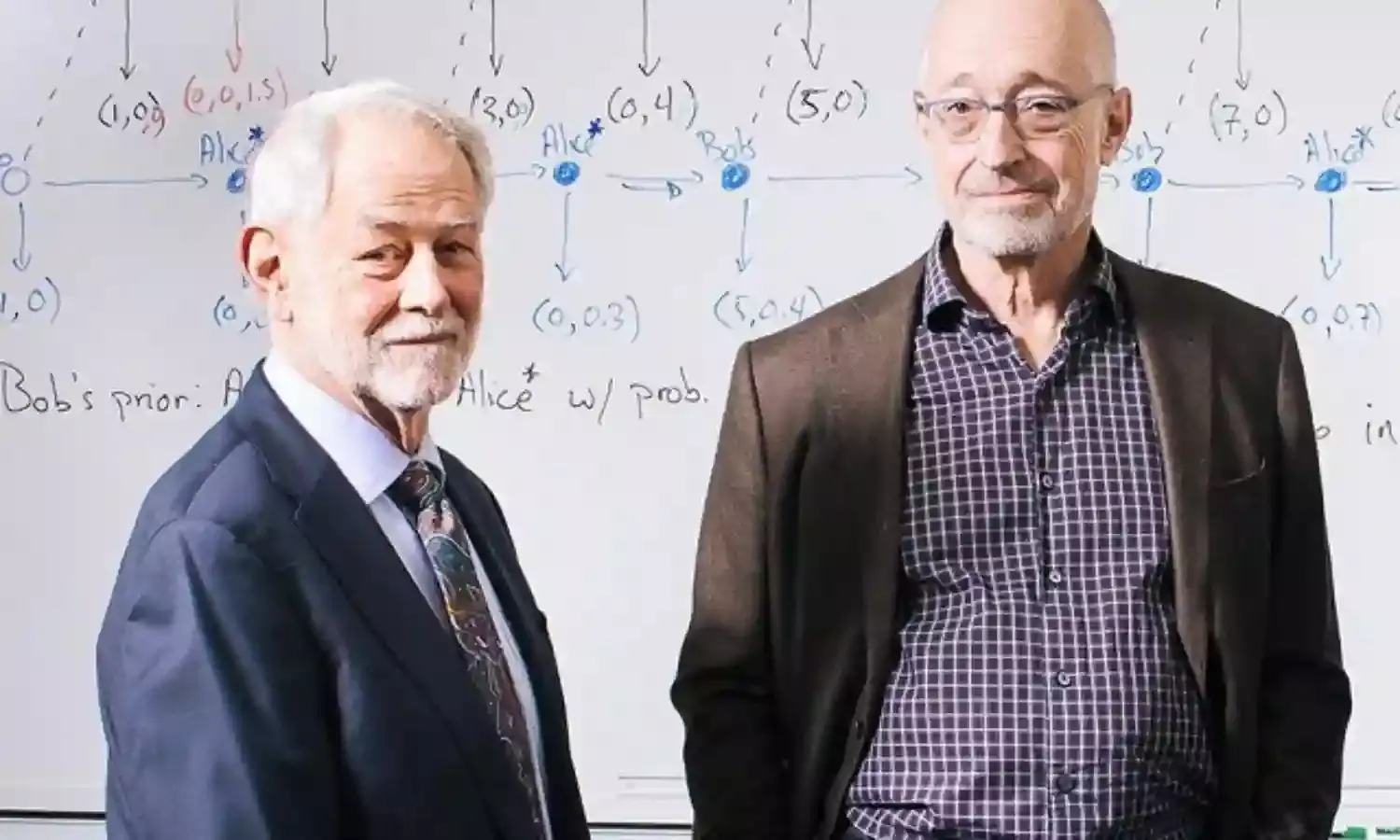

Last year it was given to Robert Wilson and Paul Milgrom for their contribution to auction theory. Humans have been selling things to the highest bidder or buying things from the cheapest source for thousands of years and sellers for the highest price they can get. These days, goods and services change hands for astronomical values at auctions daily not just at Sotheby’s but by states selling natural resources. Wilson and Milgrom devoted a lifetime to study how auctions work.

They have also translated their theories into practice and created new auctions for goods and services that are difficult to sell through traditional means, such as radio frequencies. Their discoveries have benefited sellers, buyers and taxpayers around the world. I am sure their work would have knocked the stuffing out of Vinod Rai’s absurd projections of 2G value.

The winners year before last, Abhijit Banerjee and Esther Duflo, won it ironically enough for their study in eastern Orissa of one the most spectacular development economic bombs of recent times. It was a scheme to replace open-fire cooking used by 3 billion of the world’s poorest people with more efficient, less polluting stoves.

The $400 million project was backed by the United Nations and launched by former US Secretary of State Hillary Clinton in 2010. It set out to reduce indoor air pollution, which kills 2 million people a year, while empowering women and helping the environment. After initial success, millions of stoves built in India were largely abandoned within four years.

Banerjee and Duflo studied the reasons for it and told the world why such an altruistic and even rational project flopped. The reasons were quite mundane, something which the worlds finest development economics and policy making minds did not anticipate. The new stoves needed more attention, prone to break down and took longer to cook food. They couldn’t be moved because they were tethered to fixed chimneys sending the smoke outside.

I don’t think Narendra Modi’s genius factored the more mundane considerations when the government of India launched its colossal public toilets scheme, which we now know is also a spectacular flop. Open defecation is once again rampant. Its little wonder that Modi has given the duo a big avoid.

But the economics Nobel winners also spawned spectacular flops. The hedge fund Long Term Capital Management (LTCM) had a plan to apply the expert knowledge and theories of academics to the real world. The collapse of this $125 billion fund directly led to the 1997 Asian financial crisis and the 1998 Russian default that brought the financial world to the brink of collapse. LTCM had recruited some of the biggest names in economics and trading, hiring people like the 1997 winners of the Nobel Prize for Economics Myron S. Scholes and Robert C. Merton to sit on their board of directors. But the combined brilliance of the top academics and high flying bankers couldn’t spot the coming disaster. Both failures highlighted an inability to understand how common people behave.

Classical economics was linked closely with psychology. Adam Smith’s other great work was “The Theory of Moral Sentiments” and dealt with the psychological principles of individual behavior. Smith emphasized the concept of empathy, the capacity to recognize feelings that are being experienced by another being. Jeremy Bentham described utilitarianism as it is the greatest happiness of the greatest number that is the measure of right and wrong" and is considered by many as the father of the welfare state.

Classical economic theory, also known as laissez faire, claims that leaving individuals to make free choices in a free market results in the best allocation of resources. Since individuals made choices the emphasis was on understanding human beings and their behavior as individual and as groups.

Neo-classical economists based their thinking on the assumptions that people have rational preferences; individuals maximize utility and firm’s profits; and people act independently. Consequently neo-classical economists distanced themselves from psychology and sought explanations for economic analysis heavily based on the concept of rational expectations. For most of the last century economics became increasingly mathematical. Much of economic theory came to be presented as mathematical models, mostly calculus, to clarify assumptions and implications.

It is not as if the switch was complete. Many great economists like Vilfredo Pareto, John Maynard Keynes and Joseph Schumpeter continued to base their analysis on psychological explanations. In more recent times this school of economics has been given greater importance and is reflected in the award of Nobel Prizes to behavioral economists like Daniel Kahneman of Princeton University and to Richard Thaler at Chicago. Banerjee and Duflo are considered development economists but the focus of their research was in how beneficiaries looked at gift horses.

The dominance of the classical school in the world of economics can be gauged by the fact that since the relatively recent inception of the Nobel Prize in Economics in 1968, the Chicago economics department faculty have won the Nobel as many as twelve times, twice as many as MIT, which has six Nobel laureates.

Seen from Harvard University’s ivory tower even MIT is considered as leaning more towards classical economic theory. Recent Harvard winners for economics such as Oliver Hart (2016), Alvin Roth (2012) and Eric Maskin (2007) were rewarded for their work based on mathematical empiricism rather than behavioral speculation. Amartya Sen (1998) was one of the few who broke this mould and won it in recognition of his work and abiding interest in welfare economics. A well-known economist explained that Sen won it for being a good person.

Every politician worth his salt knows that national mood and perceptions are decisive in determining national outcomes. And often people do not always make rational choices, something that marketers of diverse products such as automobiles and soap, and political dreams know. But economists took their time recognizing this, and the Nobel Committee even longer.